Bitcoin hit pause, but these 3 Altcoins ran a marathon in 2025

The year 2025 in the cryptocurrency market will be remembered for its clear split. Bitcoin spent the year moving sideways and finding a new price level, while a few Altcoins delivered strong, utility-driven growth. Bitcoin acted like the market’s anchor, but smaller assets with valuable features and growing communities took the spotlight.

This article looks at Bitcoin’s quiet performance in 2025, explains what Altcoins are, and highlights the three top performers: Hyperliquid (HYPE), XRP (XRP), and TRON (TRX). These assets pushed forward and delivered triple-digit gains even while Bitcoin moved within a range.

What are Altcoins?

Before you look at how the market behaved in 2025, you need a clear idea of the assets that shaped most of the growth that year.

The word Altcoin comes from the phrase "alternative coin" and refers to any cryptocurrency other than Bitcoin (BTC).

Bitcoin was built mainly to serve as digital money and a store of value. Altcoins were created for many other purposes. Some power smart contracts and dApps aim to improve global payments by enabling faster, cheaper transactions. They act as a testing ground for new ideas across Web3, DeFi, payments, and digital ownership. Since Bitcoin stayed quiet for most of 2025, Altcoins with clear use cases and stronger technology attracted more attention and investment.

Bitcoin hit pause

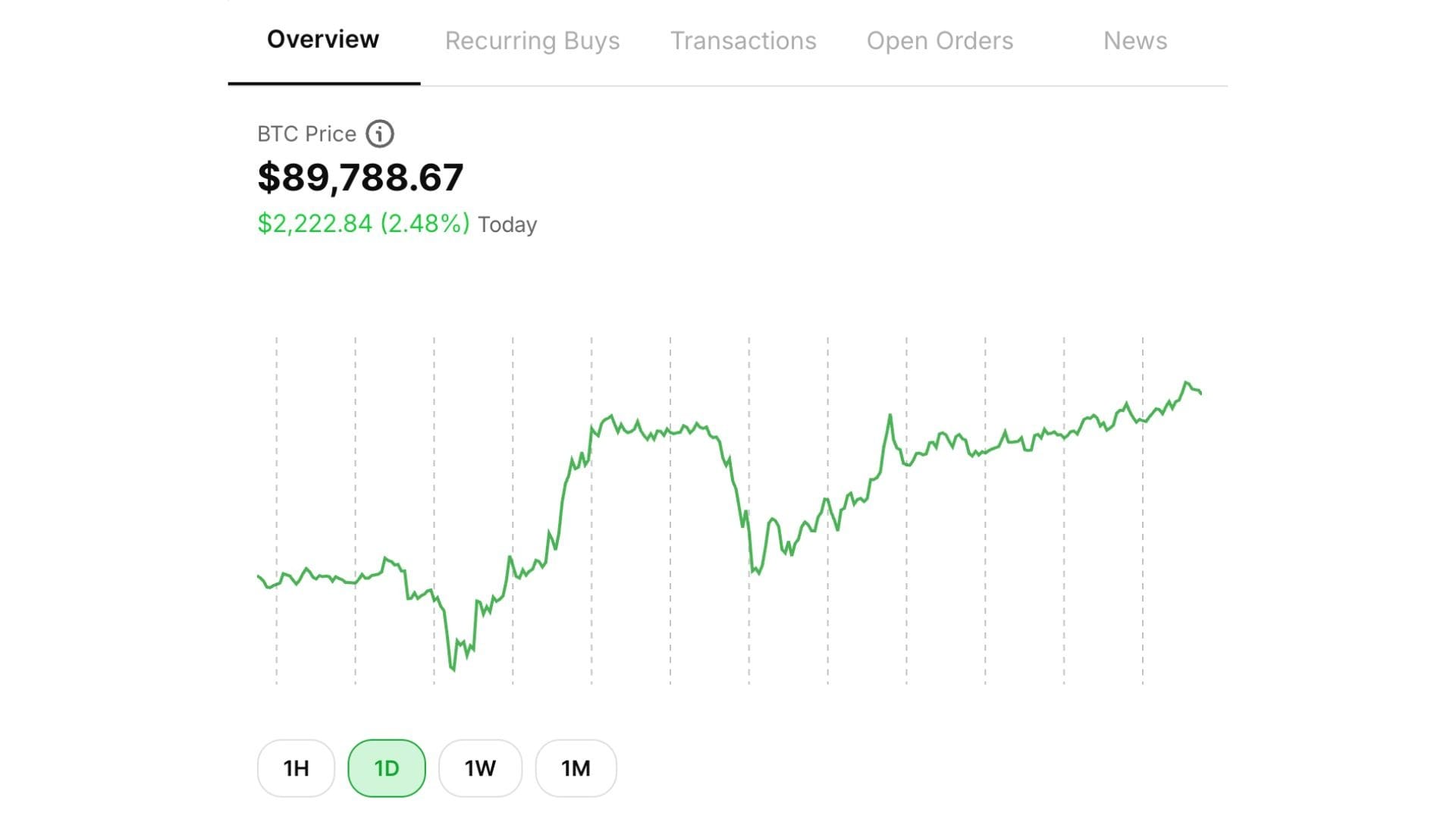

After substantial gains following the 2024 Halving and the launch of spot Bitcoin ETFs, Bitcoin entered a year of steady consolidation. Its price in 2025 came with sharp moves but kept returning to a broad range, especially toward the end of the year.

Bitcoin's price journey in 2025:

- Q1 Momentum Fades: Bitcoin opened the year near $100,000 in January. The early push did not last because the market was still adjusting from the previous bull run.

- The Pullback: By March and April, the price came under intense pressure and dropped as the market worked through a major reset in leverage.

- Summer Relief and All-Time High: A strong bounce followed during the summer. Some sources point to a peak near $126,000 in October, supported by better macro conditions and fresh institutional interest.

- Q4 Correction and Range Bound: The last quarter brought a sharp correction. The price fell from the October high and settled between $85,000 and $95,000 by early December. This period brought mixed macroeconomic signals, ETF outflows, and lower risk appetite.

Analysts near year-end agreed that Bitcoin had entered a period of flattening. It had already absorbed most of its usual yearly pullback and ended the year quietly with an apparent loss, especially when compared to the strong growth seen in the Altcoins mentioned. Bitcoin remained the most critical asset in the market, but the momentum shifted to projects driven by utility and growing adoption.

The marathon runners: 3 Altcoins that outperformed

Bitcoin moved sideways in 2025, but three Altcoins with strong use cases pushed ahead. A high-performance DEX, a regulated payments token, and a stablecoin network delivered strong year-to-date returns. Their growth showed how much utility and clear direction can shape your investment results.

1. Hyperliquid (HYPE): Year to Date (YTD) Gain (as of late August 2025): 86.23%

Hyperliquid’s rise came from its push to become the leading place for decentralised perpetual futures trading. It offered the feel of top centralised exchanges with complete on-chain transparency.

Key performance drivers:

- Technological Supremacy: The launch of HyperEVM in February 2025 and CoreWriter in August made it possible for the HyperCore engine to connect smoothly with the wider EVM world. This created a fully on-chain order book that matched the speed of centralised platforms and marked a strong technical step forward.

- Exponential Growth in Metrics: Core metrics grew sharply. Total Value Locked (TVL) moved from $2.1 billion to more than $5 billion. Weekly trading volumes crossed $78 billion in May. Unique addresses grew by 78% in the first half of the year.

- Profitability and Deflationary Tokenomics: Hyperliquid became one of the most profitable protocols in crypto, recording annualised revenues above $800 million. About 97% of these fees went into HYPE buybacks and redistribution, creating steady buy pressure and reducing supply.

- Institutional Endorsement: Some Nasdaq-listed companies, including Eyenovia and Lion Group Holding, added HYPE to their treasury. Partnerships with BlackRock and the release of new spot ETFs tied to the HYPE ecosystem strengthened confidence.

2. XRP (XRP): Year to Date (YTD) Gain (as of late August 2025): 37.13%

XRP’s rise came from the return of regulatory clarity, which removed a significant barrier and opened fresh interest from institutions. It allowed XRP to move toward its long-standing goal of powering global settlement.

Key performance drivers:

- SEC Lawsuit Resolution: The settlement of the U.S. SEC lawsuit against Ripple Labs was the turning point. The end of uncertainty unlocked adoption and investment that had been held back for years.

- Spot XRP ETFs Launch: With clarity restored, major institutions rolled out U.S. spot XRP ETFs in November 2025. Canary's XRPC ETF recorded $58 million in first-day volume, showing strong demand for a regulated XRP product.

- Real World Payment Utility: Ripple secured a significant partnership with Mastercard and Gemini in November to test the settlement of credit card payments using RLUSD on the XRP Ledger (XRPL). This proved how XRP tech can plug into everyday finance.

- Ecosystem and Institutional Funding: The XRPL ecosystem grew fast. RWA market capitalisation rose 215% in Q3. A $500 million funding round from Citadel Securities and BlackRock supported Ripple’s $40 billion valuation and signalled trust in its future role in tokenisation.

3. TRON (TRX): Year to Date (YTD) Gain (as of late August 2025): 32.58%

TRON’s strong 2025 performance stemmed from its steady role as the primary settlement layer for stablecoins, especially in fast-growing emerging markets. Its success demonstrated the power of simple, low-cost infrastructure.

Key performance drivers:

- Unrivalled Stablecoin Dominance: TRON hosted more than 42% of all USDT by Q3 2025. Daily transfer volumes reached $22.7 billion. It processed 65% of all global retail USDT transfers under $1,000, making it the preferred option in Asia and Latin America due to near-zero fees.

- Strategic Stablecoin Expansions: The addition of PayPal USD (PYUSD) in September and the launch of USD1 in June strengthened TRON’s position in the stablecoin world.

- Sustained High User Activity: TRON held the second spot behind Solana in daily active users, recording around 2.6 million users in Q3. Activity surged to a single-day peak of 12.6 million transactions in October.

- Cost and Efficiency Leadership: A governance vote in August cut base transaction fees by 60%. This kept TRON among the most affordable options for cross-border payments. Record revenue of $1.2 billion in Q3 and a strong revenue burn rate supported its financial health and deflationary model.

The key takeaway

The 2025 crypto market taught you something important. Bitcoin gave the ecosystem strength and liquidity, but the most significant gains came from Altcoins that solved clear problems for users and businesses. Hyperliquid’s high-speed and profitable DeFi engine, XRP’s regulated global payment rail, and TRON’s stablecoin network showed how much useful technology can shape your investment decisions. These Altcoins moved beyond simple speculation and started taking real market share from older systems.

As you plan your next steps in the crypto market, the message is simple. Innovation and adoption will shape the strongest portfolios, not only how closely something moves with Bitcoin.

You can trade all the Altcoins listed here on Busha.