How your savings would look if you saved in Crypto in 2025

2025 was a challenging year for most crypto holders. Bitcoin hit a record high, then crashed, wiping out more than $1 trillion in market value. Prices moved up and down so quickly that many people became nervous about investing in crypto.

Even with all that, a few coins stayed strong. Hyperliquid (HYPE) was the standout. It gained 86% by late November while many significant assets struggled. This gives you a simple idea of how your savings might look if you invested in a high-performing coin instead of keeping everything in cash.

For this test, imagine you saved $100 on the first day of each month from January to November. That is a total of $1,100. The goal is to see how that money would have grown if you used dollar-cost averaging to buy HYPE each month.

Why timing matters

Even though HYPE had a solid year, your return depends on when you bought it. Prices were high in the middle of the year, so you picked up fewer tokens at that time. You also held through the late-year drop. Buying at different prices gives you a clearer view of what an everyday saver experiences during a volatile year.

Why Hyperliquid (HYPE) was used for this test

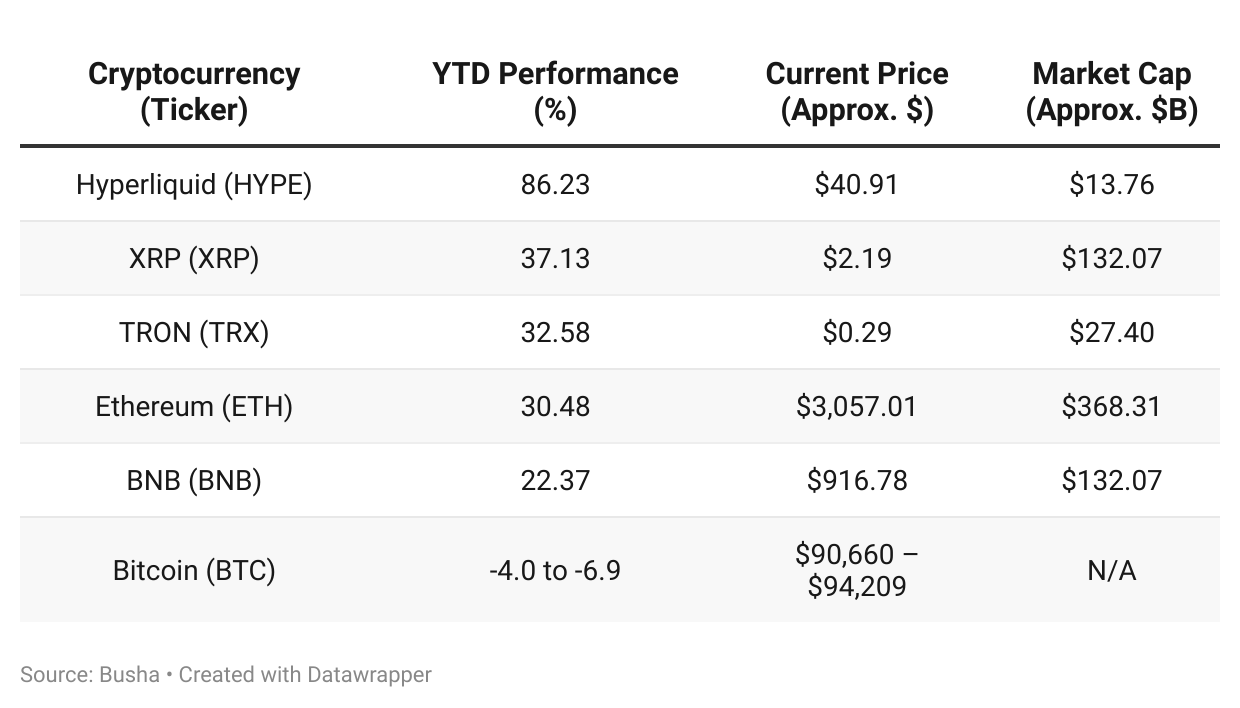

HYPE had the strongest growth among the large coins in 2025. XRP gained 37%, TRON gained 32%, Ethereum gained 30%, and BNB gained 22%. HYPE was far ahead of them. HYPE also rose while Bitcoin was negative for the year, indicating it was moving on its own strength.

Top crypto performance in 2025 (YTD as of Nov 2025)

The savings test: Buying small amounts every month

This savings test follows a simple plan. You put in $100 on the first day of every month from January to November. That gives you a total of $1,100 invested in HYPE.

To keep the numbers grounded, the model uses three price points. HYPE started the year at about $21.97, climbed through the middle of the year, and ended November at $40.91. The monthly prices in between reflect the substantial rise in mid-year and the sharp fall that followed.

What the monthly buying shows

There is a complete table covering each month, the number of tokens bought, and the total value at the end of the period. That step-by-step view shows how many tokens you got when prices were low and how few you picked up when prices were high.

Hypothetical Monthly Savings Calculation for Hyperliquid (HYPE) in 2025 (Jan–Nov)

What your savings turned into

After eleven months of saving, you put in $1,100. By the end of November, your HYPE tokens were worth $1,188.45. That gives you a profit of $88.45, which is about an 8% return.

The result is much lower than HYPE’s headline yearly growth rate due to timing. You bought more tokens early in the year when prices were low, then bought fewer during the July peak. Your average cost was around $37.89 per token. This protected you from the worst of the late-year crash but also limited how much you gained because most of the growth happened before the larger deposits went in.

The test shows what happens when you save through a rise and a fall. You avoid deep losses, but you also miss the whole upside during a fast climb followed by a sharp correction.

Why Hyperliquid performed well in 2025

Hyperliquid grew because the platform was busy and generated substantial revenue. Traders used it heavily, which created fees. Part of those fees was used to buy HYPE from the market, and that steady demand helped support the token.

In one year, Hyperliquid made about $596 million in revenue and was on track to pass $1 billion. On busy days, it earned more in fees than many major protocols. Buybacks gave holders an implied yield of about 3% to 4%, and staking added another 2%. These helped HYPE stay stable when other assets were dropping.

What went wrong in Q4

The entire market crashed in Q4. More than $1 trillion disappeared in six weeks. Bitcoin fell below $90,000, traders were liquidated, and fear spread. HYPE also dropped because it was tied to the broader market during that period.

There was another challenge. Hyperliquid had a large token unlock starting in late November. About 9.9 million new HYPE tokens would enter the market every month for two years. With HYPE around $40, that is about $396 million in new supply each month. The platform’s buybacks supported only a monthly demand of $90-$100 million. The supply pressure was much higher, and investors reacted early.

What the savings test teaches you

If you added small amounts throughout the year, you achieved a modest 8% gain. It is far smaller than the headline 86% because timing matters. You followed a safe approach, but you also entered after the most significant move.

Two things matter when saving in crypto.

Pick tokens with substantial revenue and steady activity. They hold up better in a weak market.

Pay attention to token unlocks and supply changes. If supply grows faster than demand, prices struggle even when the project is solid.

These help you save with more clarity and reduce unnecessary risk.

The Busha stack race

To encourage consistency, Busha created the Stack Race. It runs from October 13 to December 28, 2025. You set a savings goal, fund your Busha wallet, and turn on Recurring Buy. As long as your automated buys continue to run, you stay in the race. You earn weekly rewards for maintaining your streak. It turns saving into something simple to follow and easier to stick with.