How Nigeria’s tax law affects your crypto

The Nigeria Tax Act (NTA) 2025 is one of the most significant tax reforms the country has seen in years. Signed into law on June 26, 2025, and set to take effect on January 1, 2026, the Act consolidates several outdated tax rules under a single system. The goal is straightforward: to make tax compliance easier, bring more people and businesses into the tax system, and increase government revenue.

The law explicitly addresses the taxation of digital assets and cryptocurrency in Nigeria for the first time. Before now, the rules were unclear, and crypto traders, investors, and businesses operated in a grey area. With this Act, the government has removed that uncertainty and officially recognized crypto as taxable.

This article will explain the new tax law for individuals, businesses, and the crypto community. You’ll learn how it affects your income, business transactions, and cryptocurrency activity. It will also share practical steps to help you prepare for January 2026 and stay compliant.

The new tax framework in Nigeria

The Nigeria Tax Act 2025

The NTA 2025 was signed into law by President Bola Ahmed Tinubu on June 26, 2025. It takes effect from January 1, 2026. The law consolidates key tax rules into a single system, including the Companies Income Tax Act, Personal Income Tax Act, and Capital Gains Tax Act. The aim is to simplify compliance, close loopholes, and enhance government revenue.

A significant aspect of this reform is rebranding the Federal Inland Revenue Service (FIRS) as the Nigeria Revenue Service (NRS). This signals stronger powers for tax collection and enforcement. The Act also formally recognizes the role of digital assets and cryptocurrencies in the economy, clarifying how they will now be taxed.

What it means for individuals (Personal Income Tax)

The Act introduces a new progressive tax system. If you earn less than ₦800,000 per year, you won’t pay any personal income tax. For higher earners, tax rates range from 0% to 25%, depending on your income level. This is particularly important if you trade or invest in cryptocurrency, as large profits could push you into higher tax brackets.

What it means for businesses (Corporate Income Tax)

The law sets new rules for companies:

- Small companies with a turnover of ₦100 million or less and assets of ₦250 million or less will pay 0% corporate tax.

- Large companies face a 30% corporate tax, but the president may lower this to 25%.

- Multinationals and big corporations with revenue of ₦20 billion or more must pay at least a 15% minimum effective tax rate (ETR).

This change aligns Nigeria with international tax standards, ensuring that big corporations, including global crypto firms, can’t avoid tax by shifting profits abroad.

How the Nigeria Tax Act 2025 affects cryptocurrency

The NTA 2025 works with other laws to define how cryptocurrency is taxed. A key law is the Investments and Securities Act (ISA) 2025, officially classifying digital assets, including cryptocurrencies, as securities under the ISA 2025.

This removes the uncertainty that existed before. The Finance Act 2023 had already listed digital assets as “chargeable assets” for capital gains tax. The new Tax Act takes it further by clarifying that profits from digital or virtual assets are taxable.

The government has also taken steps to make sure taxes can be collected. For example, the SEC cracked down on offshore exchanges like Binance and KuCoin, while licensing local exchanges like Busha. The Central Bank of Nigeria (CBN) also lifted its ban, allowing banks to work with licensed crypto platforms.

This means the government encourages users to use regulated local exchanges that are easier to monitor. If you use a licensed exchange, your transactions can be tracked more easily for tax purposes.

When you pay tax on cryptocurrencies (Taxable Events)

As a crypto user in Nigeria, your activity will be taxed in two ways: Capital Gains Tax (CGT) or Income Tax, depending on what you do.

1. Capital Gains Tax (CGT)

You are expected to pay a 10% flat rate on profits when you dispose of crypto. Disposal includes:

- Exchanging cryptocurrencies for fiat (Naira, KES, USD, GBP, etc).

- Swapping one coin for another (e.g., Bitcoin for Ethereum)

- Using crypto to buy goods or services

Losses from cryptocurrency can only be used to offset cryptocurrency gains. You can’t use them to reduce your salary or business income.

2. Income Tax

If you earn crypto from activities beyond simple trading or investing, it is taxed as income. The rates follow the new personal income tax bands (from 7% to 24%). Activities taxed as income include:

- Mining rewards.

- Prizes, winnings, honoraria, grants, or awards.

- Staking, lending, or liquidity provision in DeFi.

- Airdrops (depending on circumstances)

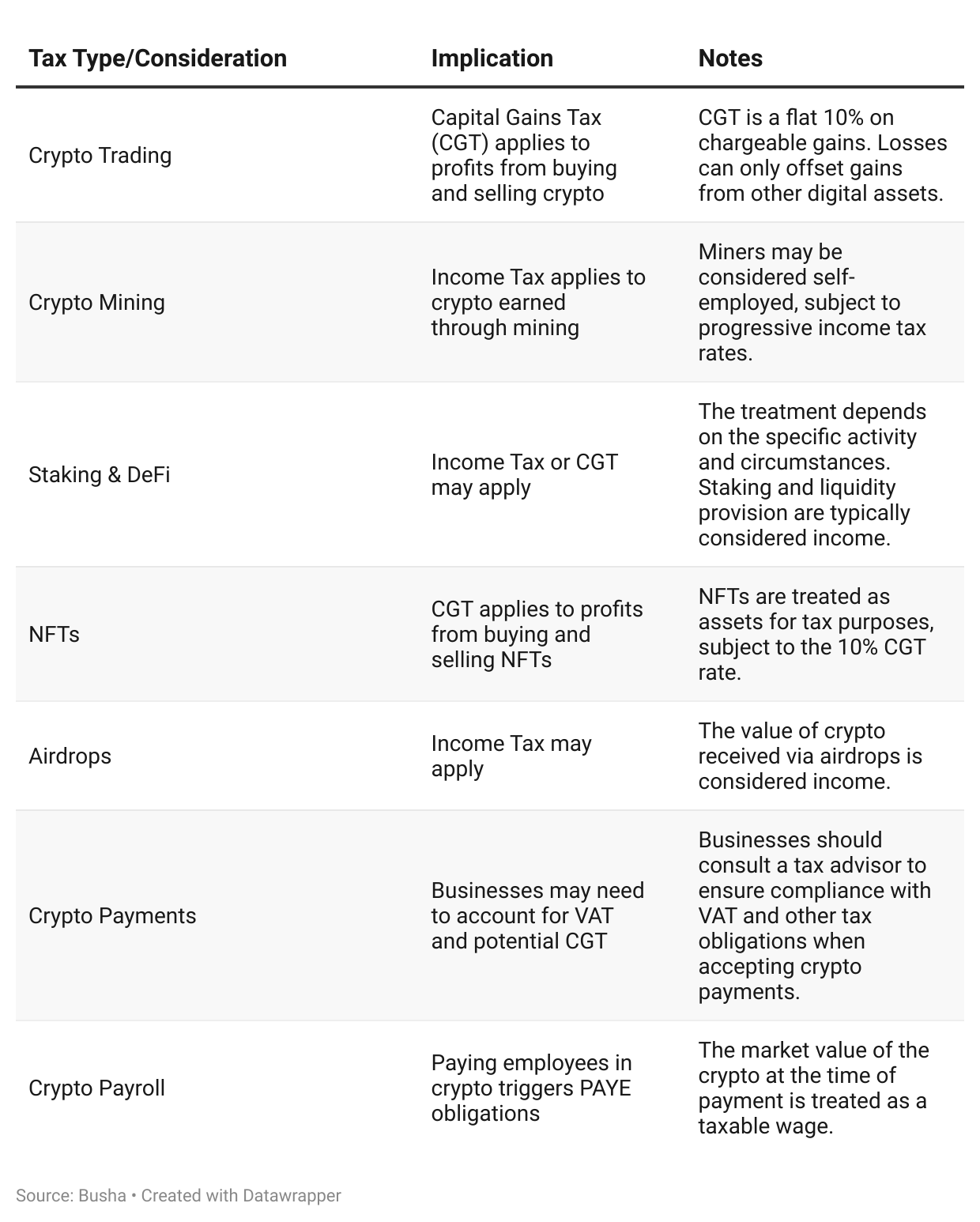

The following table clearly summarizes how everyday crypto activities are classified under the new tax regime.

Tax obligations for Crypto businesses

If you run a crypto business or serve as a service provider in Nigeria, you must follow the same rules as other companies:

- Corporate Income Tax: 0% for small businesses and up to 30% for large ones.

- Value Added Tax (VAT): 7.5% applies if your business accepts crypto payments or offers crypto-related services.

- Payroll Tax: If you pay employees in crypto, the value of the crypto at the time of payment is treated as salary. Standard PAYE and payroll rules apply.

The Federal Inland Revenue Service (FIRS) now works with the Economic and Financial Crimes Commission (EFCC) to enforce compliance. Instead of chasing millions of Nigerians individually, the government relies on licensed crypto exchanges to ensure accurate reporting. This makes businesses the primary channel for tax enforcement, so maintaining proper records is crucial.

Non-compliance attracts a fine of ₦10,000,000 for the first month of default and ₦1,000,000 for each subsequent month. In addition, licences may be suspended or revoked.

How to stay compliant with the New Tax Law

1. Keep clear records of your crypto transactions

The most crucial step to staying compliant is keeping good records. You are responsible for showing proof of all your crypto transactions; if you don’t, it could create problems for you later.

For every transaction, record:

- The date and time

- The type (buy, sell, swap, mining, or staking)

- The number of coins or tokens (for example, 0.5 BTC)

- The value in Naira at that exact time

- The purpose of the transaction

- Any fees, including network or gas fees

Using crypto tax tools or reconciliation software can make this process much easier, as they pull data directly from your exchanges and wallets. This helps you calculate profits or losses accurately and provides reliable records in case the tax authorities request them.

2. Filing your taxes with the FIRS

You will file and pay crypto taxes through the FIRS TaxPro Max System, Nigeria’s primary online platform for tax registration, filing, and payments. Businesses and individuals involved in crypto are expected to use it.

The new law also requires taxable businesses to use an Electronic Fiscal System (EFS) once the Nigerian Revenue Service rolls it out. This means all your taxable transactions will have a digital record.

If you trade crypto, take note of the special filing rule: you must file your Capital Gains Tax (CGT) returns twice every year, by June 30 and December 31.

3. Enforcement and penalties

The Federal Inland Revenue Service (FIRS) works closely with the Economic and Financial Crimes Commission (EFCC) to enforce these rules. This means that tax evasion in crypto is not just a financial issue; it can also lead to criminal investigations. Penalty ranges from as low as ₦10,000 to ₦10,000,000 and/or up to three (3) years imprisonment.

With the laws in place, digital filing systems for tracking, and the EFCC for enforcement, the government now has a strong structure to ensure compliance. Ignoring the rules puts you at serious risk.

What this means for you and how to prepare

Gaps in the New Tax Law

Although the new tax laws provide more clarity, some areas remain unclear. For example, the law does not clearly define what counts as a "digital asset." The Investment and Securities Act (ISA) classifies them as securities, but questions remain regarding NFTs, DeFi tokens, and airdrops.

Another issue is calculating crypto's value in cases where prices change quickly. This makes accurate record-keeping even more critical, especially for peer-to-peer and decentralized trades. If there’s ever an audit, your personal records will be the main proof of your gains or losses.

Practical advice for you

If you trade or invest in crypto:

- Treat all your crypto income and gains as taxable starting January 1, 2026.

- Use trusted and licensed exchanges like Busha. Their records are reliable and can help you file taxes with less stress.

- Start keeping records now. Tax software can help you track every transaction and save time in the long run.

If you run a crypto business:

- Ensure your company is registered as a licensed VASP and compliant with SEC and CBN rules.

- Update your accounting system to include crypto payments, salaries, or transactions.

- Work with a tax advisor who understands digital assets, so you don’t miss anything.

Looking ahead

The new tax rules for crypto in Nigeria are a turning point. As of January 2026, the government expects full compliance, backed by legal authority, digital filing systems, and enhanced enforcement.

For you, this means crypto is no longer outside the tax net. Staying proactive and transparent with your records and filings is the safest way to protect your money and avoid penalties.

Read more: