You would have doubled your money if you did this every Friday in 2025

Crypto can feel like a chase for many people. One moment, the Naira (₦) looks stable, and the next moment, a global update sends Bitcoin flying. You try to catch the move, but the fear of buying at the top and watching the price drop immediately can drain your confidence.

There is a more straightforward way to invest. A steady and calm approach that helps you avoid panic decisions and could have doubled your money in one year. Many people are already using it without stress.

That strategy is Dollar Cost Averaging, often called DCA. If you are new to crypto or tired of second-guessing every chart, DCA gives you structure and peace of mind.

What is DCA?

DCA means Dollar Cost Averaging. Even though the name uses Dollar, the idea works in any currency so we will explain it with Naira (₦).

Instead of saving ₦520,000 for the whole year and making a single big purchase at the end, you invest a fixed amount, like ₦10,000, every week. You buy at high prices, low prices, and everything between, which helps smooth out the impact of price swings.

Why DCA matters for you

Crypto prices can jump or fall by 10% to 20% in one day. Add Naira (₦) fluctuations and cross-border payments, and it becomes even harder to time the market.

DCA helps you manage all that by giving you a pattern you can follow every Friday.

- Eliminates emotional trading: You already know the amount you will buy each week. You do not wait for dips or chase spikes.

- Reduces risk of buying the peak: Spreading your purchases across 52 weeks lowers your average entry price.

- Perfect for consistent income: If you earn monthly or weekly, DCA fits into your routine and turns part of your income into long-term value.

The 2025 DCA Challenge: Could you have doubled your money?

To understand how powerful DCA can be, you need to look at a simple and practical example in Naira (₦). Imagine you decide to invest a small amount in Bitcoin every Friday through all 52 weeks of 2025. Nothing stressful. Just a steady weekly commitment.

The Scenario

- Asset: Bitcoin (BTC)

- Investment Frequency: Every Friday

- Weekly Investment Amount: ₦10,000

- Total Investment Period: 52 Weeks

You aim to buy a fixed amount of Naira (₦) each week. This helps you avoid timing the market and gives you a better chance of lowering your average cost as prices move up and down.

The DCA calculation (Hypothetical Naira (₦) values for illustration)

Let us use a simplified 12-week period to show how this works. During those 12 weeks, BTC moved through different prices.

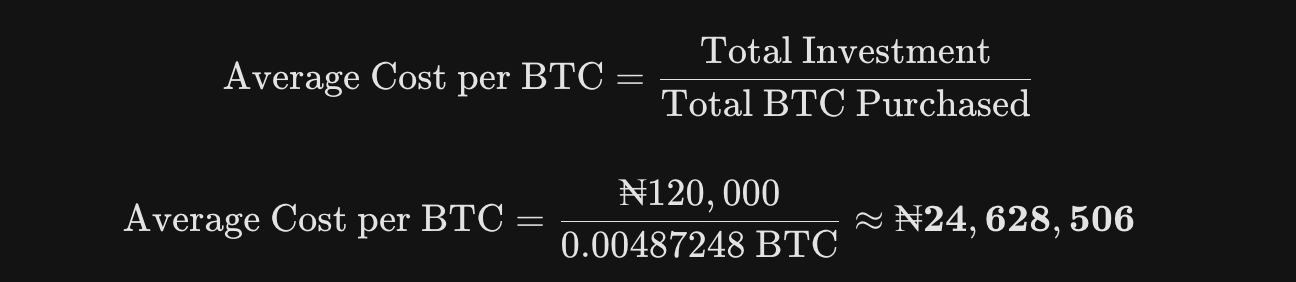

Total Investment in 12 Weeks: 12 x ₦10,000 = ₦120,000

Total BTC Purchased: 0.00487248 BTC

Calculating your actual average cost

The goal of DCA is to get an average purchase price that beats the simple market average.

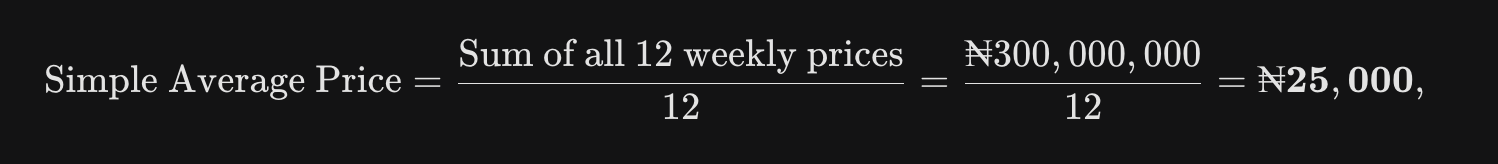

Now compare this to the simple average market price over the 12 weeks:

Your DCA average cost (₦24,628,506) is lower than the simple average market price (₦25,000,000). You bought more BTC when the price dropped to ₦20m and ₦21m, and you purchased less when it climbed to ₦29m or ₦30m. Your weekly habit quietly worked in your favour.

Try out our bitcoin calculator

Doubling your money in 52 weeks

Now, let us extend the same idea across all 52 weeks of 2025.

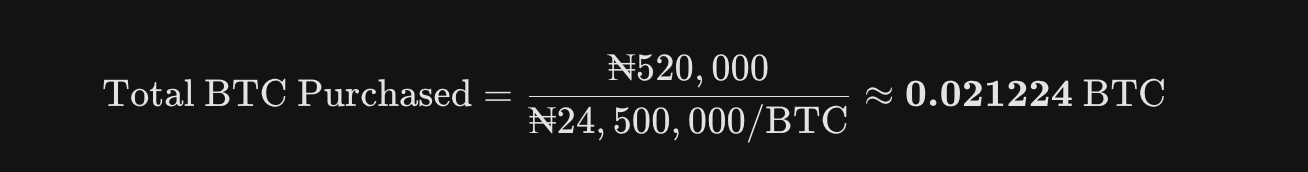

- Total investment: 52 weeks x ₦10,000/week = ₦520,000

- Total BTC purchased (Estimate): Based on the superior cost-averaging above, let's assume your final average cost over the volatile year is ₦24,500,000 per BTC.

- The goal: Doubling your money: Doubling your initial investment of ₦520,000 means your total portfolio value must reach ₦1,040,000.

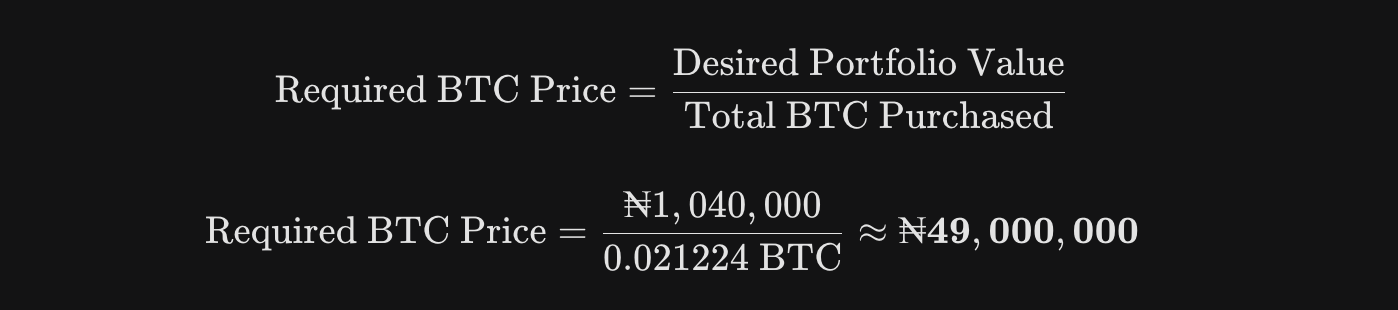

- The required exit price: What price would BTC need to reach at the end of the year for your 0.021224 BTC to be worth ₦1,040,000?

The verdict: Why it is possible

In this scenario, if Bitcoin had moved from an average of about ₦24.5 million to ₦49 million by the last Friday of 2025, you would have seen a 100% gain. Your ₦520,000 would have grown to ₦1,040,000 simply by following the ₦ 10,000-every-Friday plan.

Crypto has a long history of moving by 100% within a single year during a bull run. By sticking to your weekly DCA amount, you did not need to guess the right entry point. You only needed to stay consistent.

Practical takeaways for you

To improve your DCA results in the Nigerian crypto market, here are helpful steps you can apply:

- Automate your DCA: This helps you avoid skipping weeks because the price looks too high. Auto buy features on Nigerian-friendly exchanges can handle this for you.

- Choose a solid asset: DCA works best on established, strong coins. Bitcoin or Ethereum are common choices for lower risk.

- Invest sustainable amounts: Use an amount you can commit to without affecting urgent needs. ₦10,000 works well, but you can choose higher or lower if it fits your income.

- Security first: Protect your crypto by moving it to a personal wallet once it reaches a meaningful size. A hardware wallet is safer than leaving everything on an exchange.

The message is simple. Big gains in crypto come from discipline and consistency. By putting a fixed amount of Naira into Bitcoin every Friday, the DCA strategy could have doubled your money in 2025. Let 2026 be the year you build with intention and avoid FOMO completely.

Automate your buys with Busha

Busha makes recurring buys easy. You choose the amount and pick how often you want your purchase to run. It can be daily or weekly. You can start small and stay steady without worrying about timing or sudden price changes.

Join the Busha Stack Race

To support your consistency, Busha created the Stack Race. It runs from October 13 to December 28, 2025. You set a savings goal, fund your Busha wallet, and turn on Recurring Buy. As long as your automated buys keep running, you stay in the race. You earn weekly rewards for keeping your streak active.

The Stack Race helps you build a simple habit and grow your Bitcoin over time.