What counts as an asset under Nigerian Law when it comes to digital assets?

Digital assets are now used for trading, investment, and payments in Nigeria. For anything to hold value in a country, you need a clear legal definition and protection. The law decides if you can claim ownership, recover stolen assets, pay taxes, or pass those assets to a family member.

Nigeria now treats digital assets as a recognised asset class. The shift shows that regulators see the financial value and the need for structure, safety, and investor confidence.

How Nigeria’s position changed

The first major response came in 2021, when the Central Bank of Nigeria prohibited banks from facilitating crypto transactions. The concern was linked to financial crime and the lack of consumer protection.

The situation changed after global standards improved and other governments started regulating Virtual Asset Service Providers (VASPs). In December 2023, the CBN issued new rules that allowed banks to work with VASPs under strict conditions.

This led to the Investments and Securities Act (ISA) 2025. It became law, formally placing digital assets under regulation and granting them legal recognition in Nigeria.

What the Law calls property and assets

1. Tangible vs Intangible Property

Traditional law separates property into two groups. You have property you can touch, like land. You also have property that exists as a legal right without physical form. Digital assets fall into the second group.

2. The Rule Called Chose in Action

A chose in action is a right you can only enforce through a legal claim. Examples include debts, shares, intellectual property, and money in a bank account. These are recognised as property under Nigerian law.

Digital assets fit into this category. This makes them property that the law can protect or recover. Even before the ISA 2025, Nigerian courts already had the foundation to treat digital assets as property.

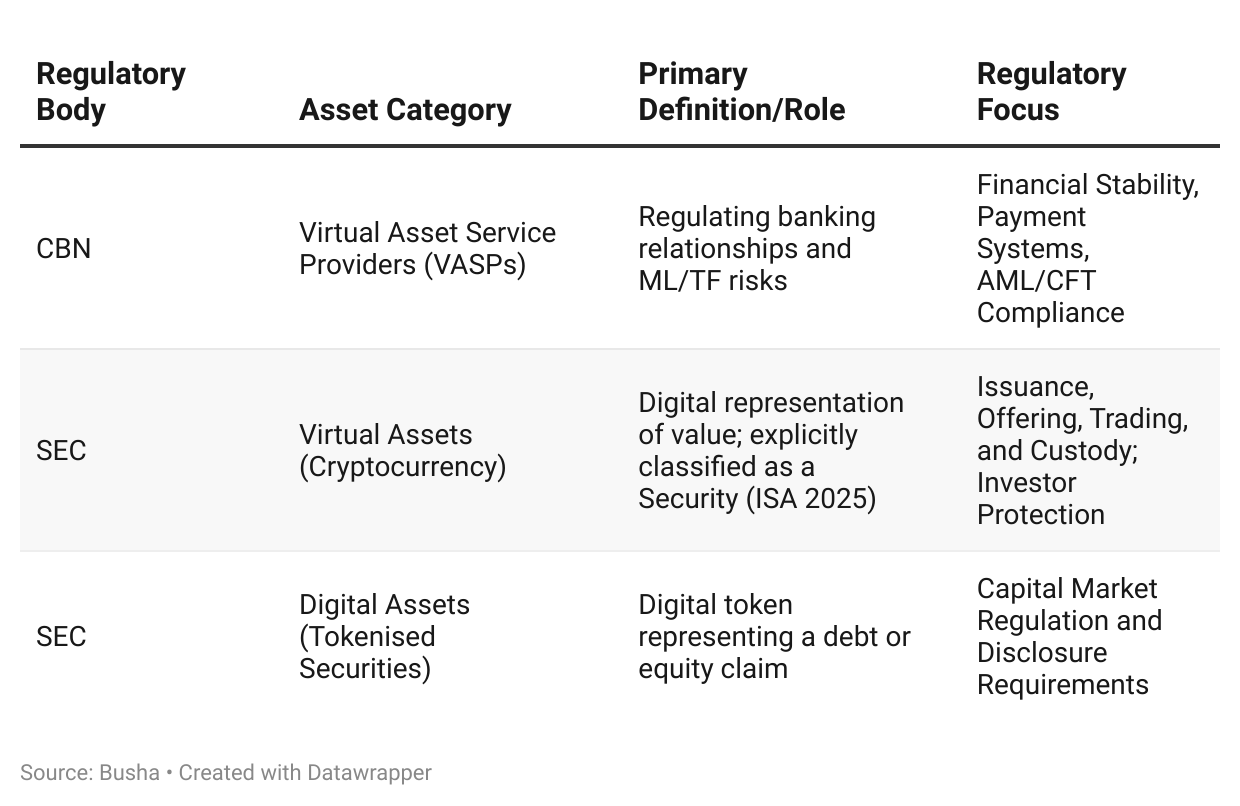

The Regulatory framework: SEC and CBN

Nigeria uses two regulators to manage digital assets. The Central Bank of Nigeria focuses on financial system safety and money laundering rules. The Securities and Exchange Commission focuses on investor protection and capital markets.

1. The Central Bank’s role

The CBN regulates how banks interact with Virtual Asset Service Providers. Its goal is to keep the financial system secure and prevent money laundering and terrorism financing.

Since the 2023 Guidelines, banks can now provide accounts and services to VASPs. They can process payments and support foreign-exchange inflows from crypto trading. The main restriction remains. Banks cannot trade crypto on their own books or hold crypto as an asset.

The Money Laundering Act 2022 also recognises VASPs as financial institutions. This brings them under mandatory reporting and compliance rules.

2. The SEC’s role

The SEC regulates digital assets that appear to be investment products. Through its 2022 Rules, the SEC created two main definitions.

Virtual Assets are digital items that hold value and can be traded or used for payment. Cryptocurrencies fall under this category.

Digital Assets are narrower. They are tokens that represent claims, such as equity or debt. They cover products such as tokenised shares and digital bonds.

This shared framework is intentional. The CBN controls the financial system and the flow of money. The SEC controls the investment side and protects you. Both regulators work together to cover different risks and prevent gaps in supervision.

Nigerian Regulator definitions and Jurisdiction in the digital asset space

Digital assets as securities under ISA 2025

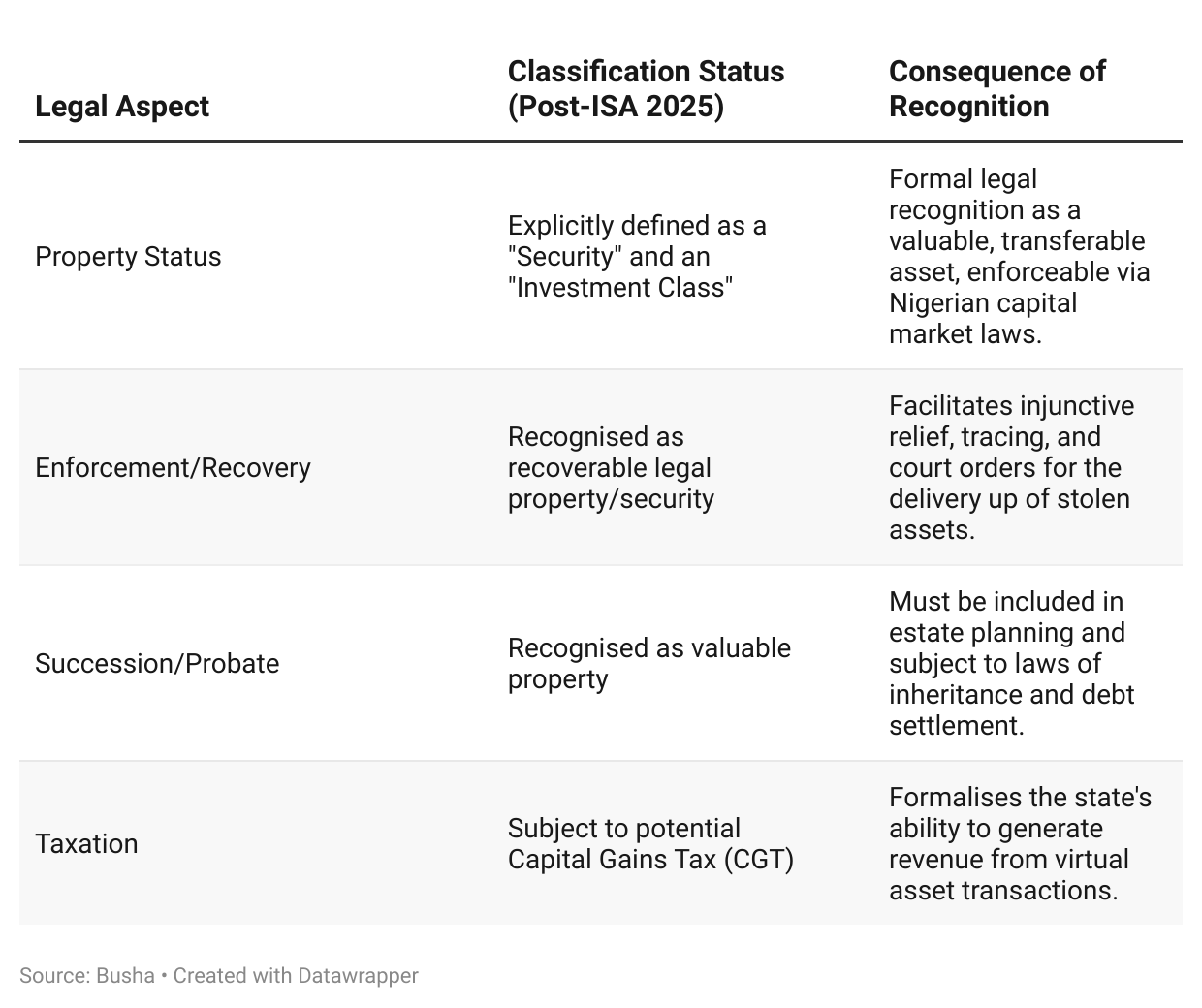

The biggest shift in defining digital assets in Nigeria came with the Investment and Securities Act 2025. It removed uncertainty by placing digital assets under the jurisdiction of the capital markets law.

Section 357 and the definition of securities

The ISA 2025 expands the meaning of securities. It adds virtual assets to that definition. This gives them formal recognition.

The SEC can regulate, register, and supervise the issuers, custodians, and exchanges.

What this means for compliance

If you issue or offer digital assets in Nigeria, you must follow capital markets rules. Whitepapers and disclosures are compulsory. Marketing aimed at Nigerians needs SEC approval.

Why this matters for tax and asset protection

Once the law recognises digital assets as securities, they become enforceable property. Your digital assets can be taxed. They can be inherited. They can be frozen or seized in legal disputes.

Legal implications of Digital asset classification under ISA 2025

Judicial precedent: Digital assets as recoverable property

The ISA provides formal recognition, but the ability to own, steal, recover, or trace a digital asset has already been tested in court.

Tracing and recovery

Courts have recognised that digital assets can be treated as property recoverable under the law. A well-known example is a 2024 English High Court case in which stolen crypto linked to a Binance account belonging to a Nigerian was traced and ordered returned.

The court used standard legal tools, such as tracing and delivery up. This shows that digital assets are treated as valuable property that can be held on trust or recovered through legal action.

Nigerian courts and digital rights

Nigerian courts have also been engaging with cases involving digital ownership. Lawyers already bring disputes involving digital assets before Nigerian courts and ECOWAS courts. There have also been early rulings from the Federal High Court dealing with digital property.

When you combine court recognition with the ISA 2025, you get two strong protections. You have the law defining digital assets as securities. You also have the courts applying the same remedies used for traditional financial assets. This creates confidence that you can claim, recover, or enforce your rights if a dispute happens.

NFTs and personal data

Nigeria not only recognises cryptocurrencies. The law already covers assets like NFTs and personal data.

NFTs and the two assets you get

NFTs involve two separate assets. The digital token itself. The underlying content, like art or music.

The art or music linked to an NFT is protected by the Copyright Act and the Cybercrime Act. The creator keeps the intellectual property rights even after you buy the token. IP rights can be enforced in court and traded, or protected.

You also have the NFT token. This token is a unique record on a blockchain. The SEC may treat it as a security if it functions as an investment contract. In most cases, owning an NFT means you hold two assets. You own the token. You may have limited rights to the content. Any dispute touches both IP law and securities regulation.

Personal data and NDPR

Personal data is also protected under the Nigerian Data Protection Regulation. It is treated as a legal right. The NDPR gives you control over how your information is collected and used.

VASPs, exchanges, and platforms must protect customer data and comply with consent requirements. This means even non-financial digital rights have legal value. Your data is protected and enforceable under Nigerian law.

What comes next

Nigeria has moved from restrictions to a structured regulatory system. The SEC focuses on the assets. The CBN monitors the financial institutions that support it.

The next stage is enforcement. Regulators are expected to focus on compliance, VASP supervision, and the collection of tax on digital asset transactions.

What you should do

If you run a platform or issue tokens in Nigeria, you must follow SEC rules. Licensing, disclosures, and whitepapers are now part of the compliance process.

You also need to protect IP rights for tokens linked to creative assets, and follow the NDPR rules for customer data. Digital assets are now recognised as property, and you must plan around legal duties and asset protection.

This framework gives you stronger confidence in using and building with digital assets in Nigeria.